By Patrick Diamond, CFP ®

I recently had the privilege to speak with members of the Rhode Island Woman’s Bar Association about personal finance, student loans, and the financial realities of a legal career. One focus of this conversation was how to best use workplace retirement plans in a tax-smart way, and watching out for hidden investment fees.

Specifically, we discussed how to identify the fees we all pay for owing mutual funds or exchange traded funds (also called ETFs) in our retirement accounts, whether that be a 401K, 403B, or IRA, etc. These fees can be tricky to find if you don’t know where to look. They can also be expensive. Fund fees can eat up a significant portion of your returns if you find yourself in a high-cost fund for several years. These fees have been trending down over the years, which is a very good thing for investors like you and me, but high cost funds still exist and you can be in a high cost fund without even knowing. This is something we regularly help clients fix to ensure they are in quality funds with low fees.

Every investment in a mutual fund or ETF has one of these annual fees called “Expense Ratios.” Why financial companies call them “expense ratios” and not simply “annual fees” is a great question. The cynic in me would say it’s because no one knows what an “expense ratio” is, but everyone definitely knows what an “annual fee” is, and perhaps it’s just an effort to sneak one past the goalie (if you know what I mean).

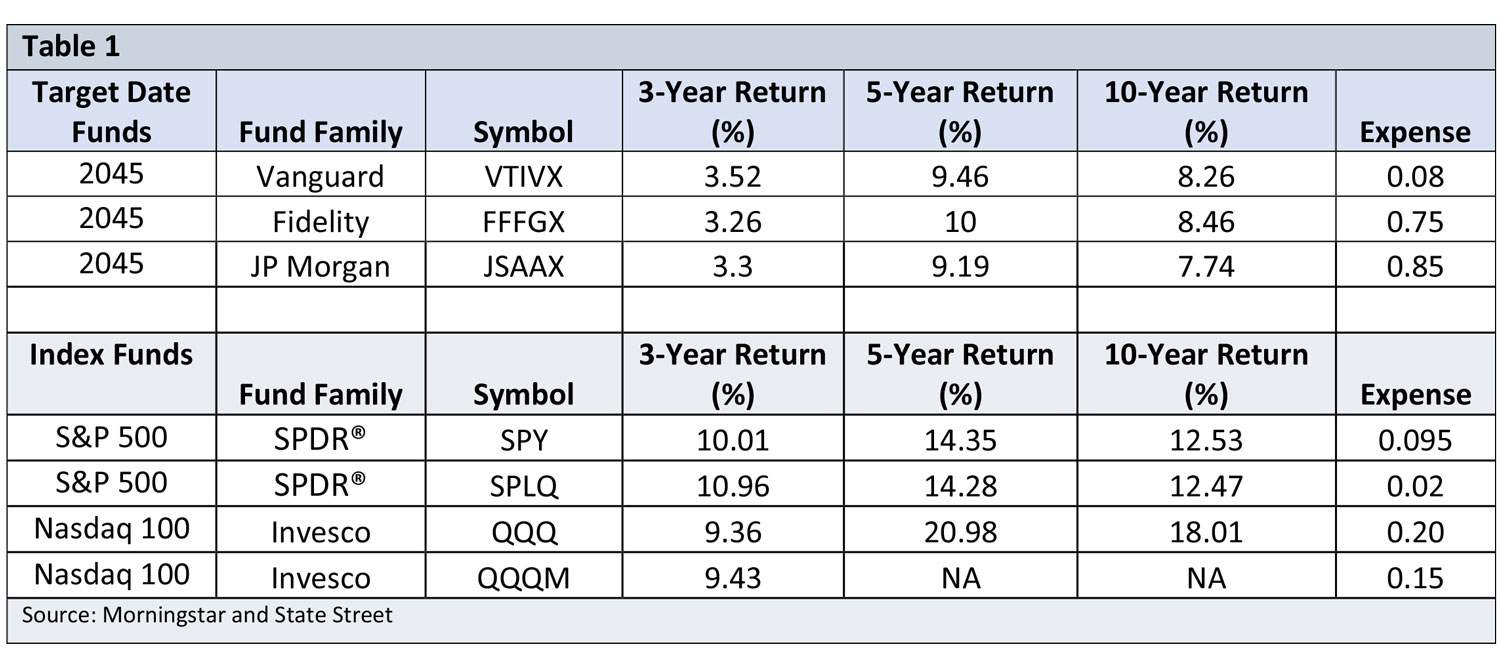

Most people are surprised to learn that funds that are essentially the same investment (i.e., similar asset allocation, similar portfolio of investments, comparable performance, etc.) can have a broad range of different fees. This fee phenomenon exists not just in broad index tracking ETFs like SPY, which tracks the S&P 500 index, and QQQ which tracks the Nasdaq 100, but also target date funds (also called target retirement funds) that are very popular in many 401Ks and retirement accounts. Table 1 illustrates this point, wherein I took a random sample of 2045 target date funds[1] to assess their annual fee. As you can see in Table 1, the annual fee (aka expense ratio) charged by these three 2045 target date funds ranges from .08 all the way up to .85. I’ve also included SPY and its identical, yet cheaper, version SPLQ, as well as QQQ and its identical, yet cheaper, version QQQM.

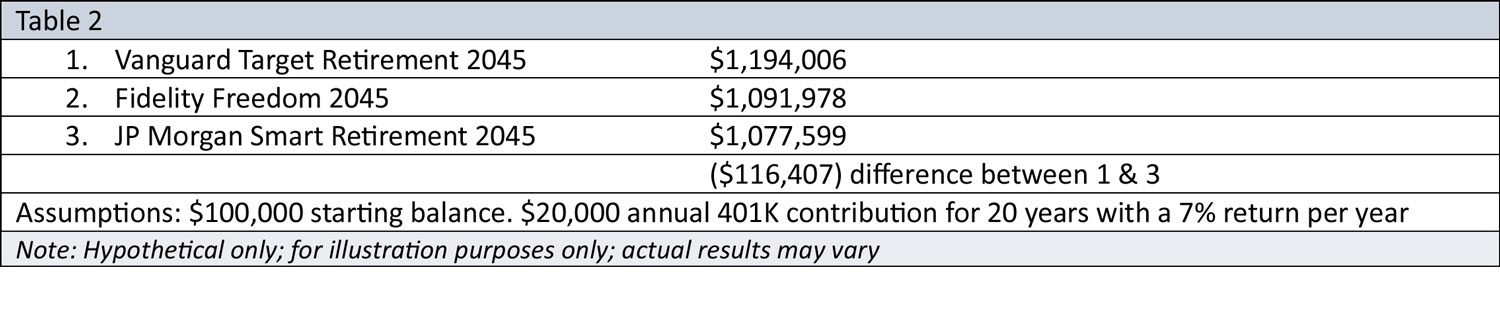

Table 2 illustrates the dollar impact of investing in a fund with a lower annual fee (aka expense ratio) versus a fund with a higher annual fee. Over the course of twenty years, the investment in the fund with the lower annual fee has a value $116,407 higher than the investment in the fund with the highest annual fee.

[1] These funds are aimed at investors looking to retire in or around 2045, and the asset mix changes as you move closer in time to the year 2045. The idea being that the fund lowers the percentage of stock investments and increases the allocation to bonds and cash equivalents as you approach the year 2045. These funds are often described as “set it and forget it” meaning the asset allocation changes without the investor having to do anything. 401Ks often use these as default investments for plan participants.

Disclaimer: Nothing in this article is meant to be tax or investment advice and is not a recommendation to invest in any particular fund. The funds mentioned herein are for illustration purposes only. Past performance is not indicative of future results. If you have questions about specific funds or fund fees please contact us via phone or email.